Unveiling The Landscape Of Hennepin County Property Taxes: A Comprehensive Guide

Unveiling the Landscape of Hennepin County Property Taxes: A Comprehensive Guide

Related Articles: Unveiling the Landscape of Hennepin County Property Taxes: A Comprehensive Guide

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Unveiling the Landscape of Hennepin County Property Taxes: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Unveiling the Landscape of Hennepin County Property Taxes: A Comprehensive Guide

Hennepin County, encompassing the vibrant city of Minneapolis and its surrounding communities, is home to a diverse tapestry of properties. Understanding the intricacies of property taxes within this dynamic region is crucial for both residents and property owners. This guide delves into the Hennepin County property tax map, its significance, and the valuable insights it offers.

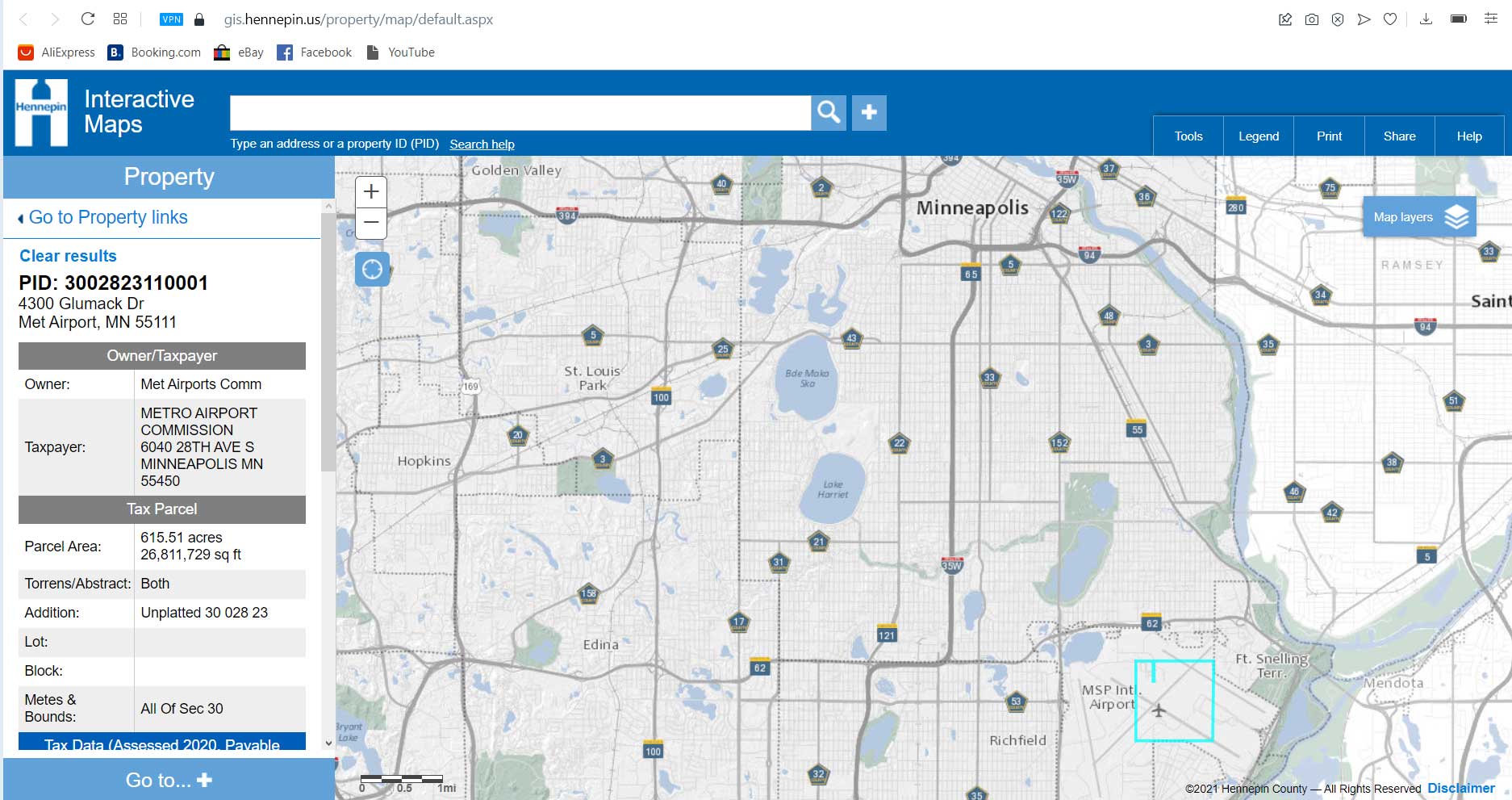

The Hennepin County Property Tax Map: A Visual Representation of Property Values

The Hennepin County property tax map is an invaluable resource, visually depicting the assessed value of properties across the county. This map, accessible online through the Hennepin County Assessor’s website, provides a detailed snapshot of property values, enabling users to:

- Compare Property Values: The map allows users to compare the assessed value of their property with neighboring properties, fostering a better understanding of the local real estate market. This information can be particularly useful when considering buying, selling, or refinancing a property.

- Identify Trends in Property Values: Observing the color-coded map reveals trends in property values across different areas. This visual representation helps identify areas experiencing rapid appreciation or depreciation, informing investment decisions and market analysis.

- Gain Insight into Tax Burdens: By correlating property values with tax rates, users can gain a clearer understanding of the tax burden on different properties within the county. This knowledge empowers residents to engage in informed discussions about property tax policies and their impact on the community.

Beyond the Map: Understanding the Components of Property Taxes

While the map provides a visual representation of property values, it is essential to understand the components that contribute to the overall property tax bill. These components include:

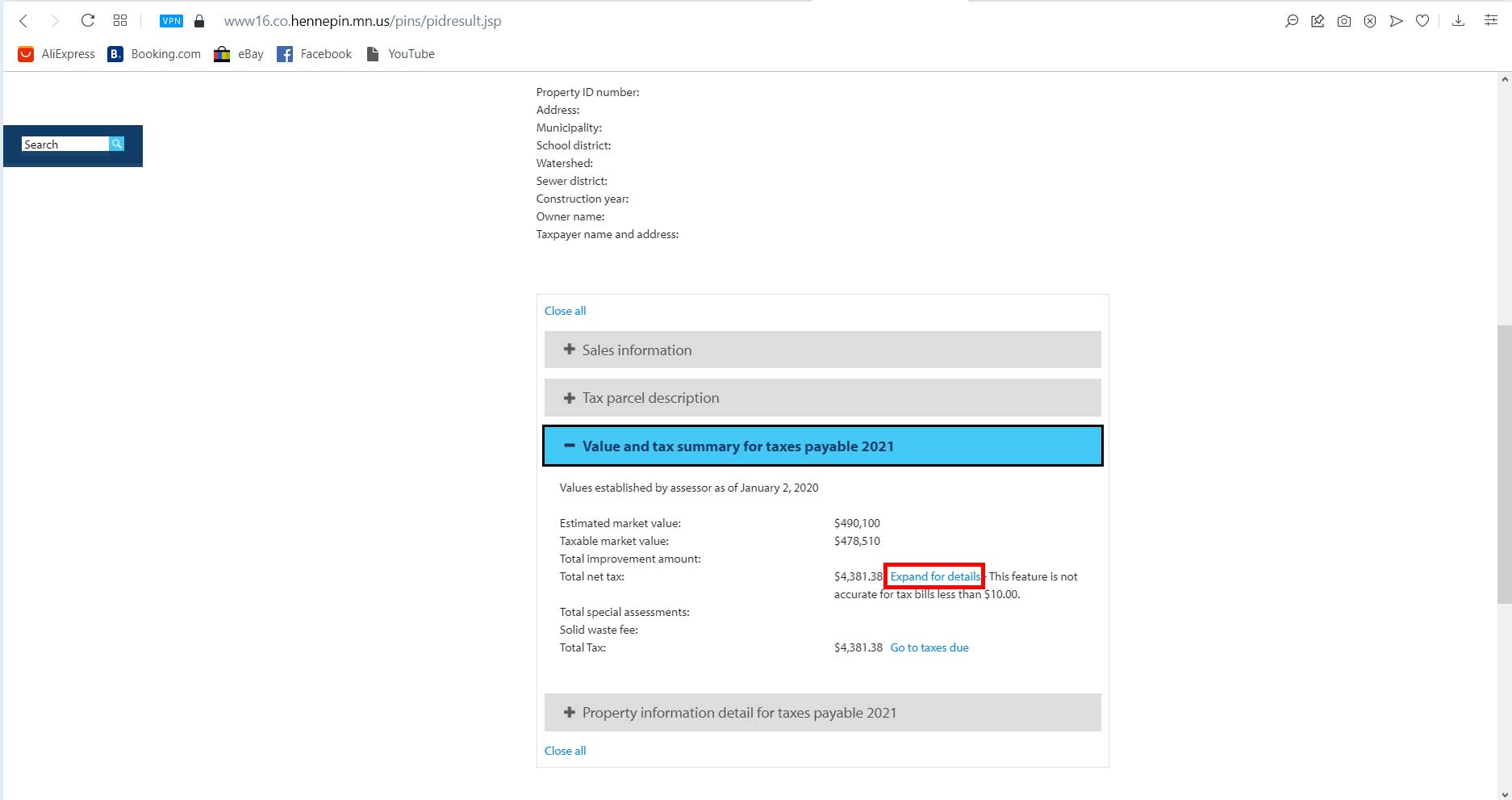

- Assessed Value: The assessed value of a property is determined by the Hennepin County Assessor’s office and reflects the estimated market value of the property as of January 1st of the current year. This value is based on factors such as property size, condition, location, and recent sales data.

- Tax Rate: The tax rate is determined by local governments, including cities, townships, and school districts. These rates vary based on the level of services provided by each jurisdiction and the amount of funding required to operate those services.

- Exemptions: Certain property owners qualify for tax exemptions, which reduce their overall tax burden. These exemptions can include exemptions for senior citizens, veterans, and individuals with disabilities.

Navigating the Property Tax System: A Guide for Residents

Understanding the property tax system in Hennepin County is crucial for residents to ensure they are paying the correct amount of taxes and maximizing potential exemptions. Here’s a breakdown of key considerations:

- Property Tax Notices: Property owners receive annual tax notices detailing their assessed value, tax rate, and total tax liability. It is essential to review these notices carefully to ensure accuracy and identify any potential discrepancies.

- Appealing Property Assessments: Property owners have the right to appeal their assessed value if they believe it is inaccurate or unfairly high. The appeal process involves filing a formal appeal with the Hennepin County Assessor’s office and presenting evidence to support the appeal.

- Tax Relief Programs: Hennepin County offers various tax relief programs for eligible residents, including programs for low-income homeowners, senior citizens, and individuals with disabilities. It is essential to explore these programs to determine eligibility and access potential financial assistance.

Frequently Asked Questions (FAQs) about Hennepin County Property Taxes

Q: How is my property’s assessed value determined?

A: The Hennepin County Assessor’s office uses a variety of factors to determine the assessed value of a property, including property size, condition, location, and recent sales data. The assessed value is intended to reflect the estimated market value of the property as of January 1st of the current year.

Q: How are property tax rates determined?

A: Property tax rates are determined by local governments, including cities, townships, and school districts. These rates are based on the level of services provided by each jurisdiction and the amount of funding required to operate those services.

Q: What are the common property tax exemptions?

A: Common property tax exemptions include exemptions for senior citizens, veterans, and individuals with disabilities. These exemptions can significantly reduce the overall tax burden for eligible homeowners.

Q: How can I appeal my property assessment?

A: Property owners can appeal their assessed value if they believe it is inaccurate or unfairly high. The appeal process involves filing a formal appeal with the Hennepin County Assessor’s office and presenting evidence to support the appeal.

Q: Where can I find information about property tax relief programs?

A: Information about property tax relief programs is available on the Hennepin County Assessor’s website and through the Hennepin County Department of Human Services.

Tips for Understanding and Managing Property Taxes

- Stay Informed: Regularly review property tax notices, attend community meetings, and consult with local government officials to stay informed about property tax policies and potential changes.

- Explore Exemptions: Research and apply for any applicable property tax exemptions to reduce your tax liability.

- Utilize Online Resources: The Hennepin County Assessor’s website provides valuable information about property taxes, including the property tax map, assessment data, and details about appeal processes.

- Seek Professional Advice: Consider consulting with a real estate professional or a tax advisor for personalized guidance and assistance with navigating the property tax system.

Conclusion: The Property Tax Map as a Tool for Informed Decision-Making

The Hennepin County property tax map is a powerful tool that empowers residents and property owners with valuable insights into the local real estate market and the property tax system. By understanding the information presented on the map and the factors that contribute to property tax assessments, individuals can make informed decisions regarding their property, engage in meaningful discussions about local tax policies, and ensure they are paying their fair share of taxes. The map serves as a visual representation of the complex landscape of property values in Hennepin County, providing a foundation for informed decision-making and responsible property ownership.

Closure

Thus, we hope this article has provided valuable insights into Unveiling the Landscape of Hennepin County Property Taxes: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!