Unlocking The Secrets Of Rankin County: A Comprehensive Guide To The Tax Map

Unlocking the Secrets of Rankin County: A Comprehensive Guide to the Tax Map

Related Articles: Unlocking the Secrets of Rankin County: A Comprehensive Guide to the Tax Map

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Unlocking the Secrets of Rankin County: A Comprehensive Guide to the Tax Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Unlocking the Secrets of Rankin County: A Comprehensive Guide to the Tax Map

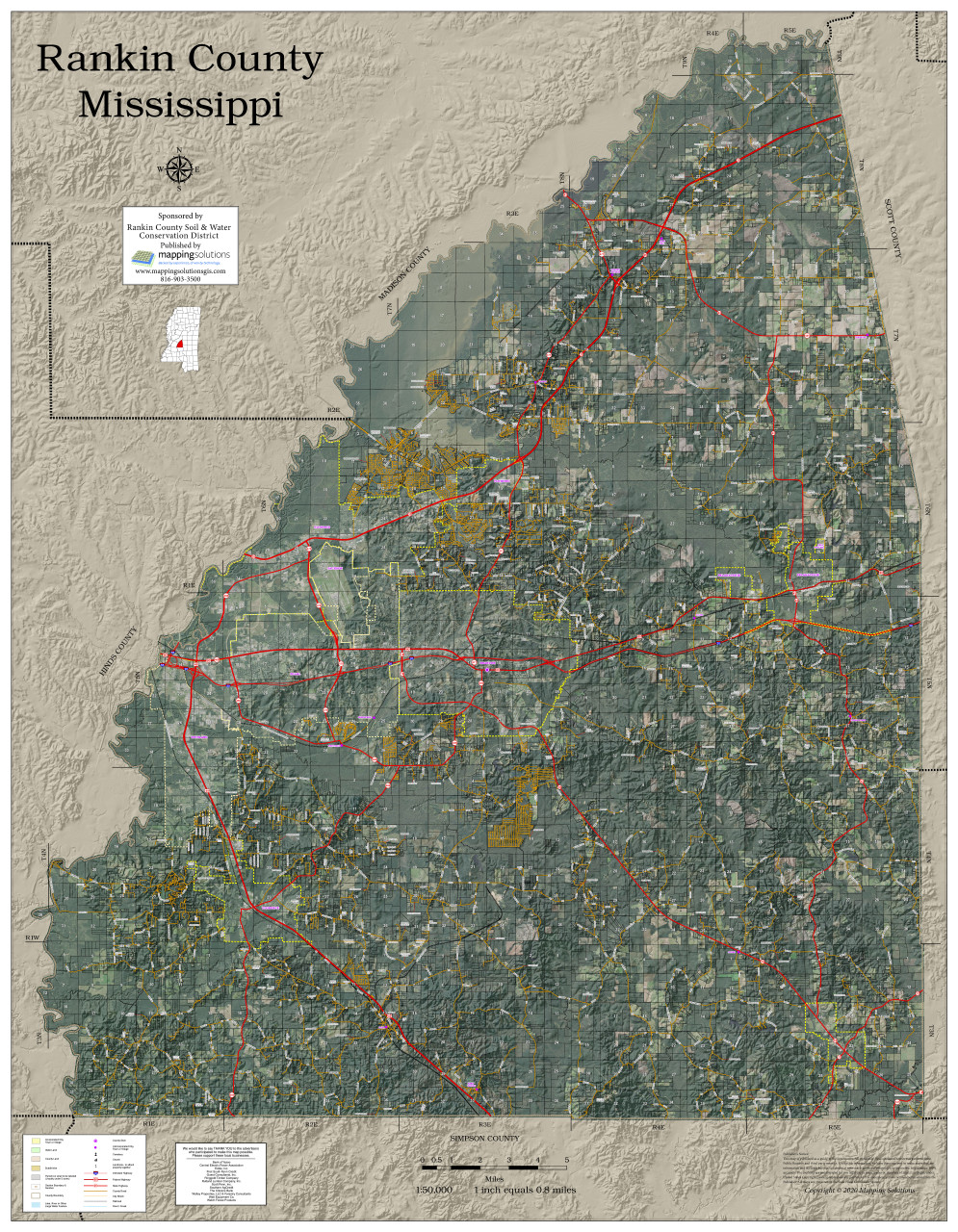

Rankin County, Mississippi, boasts a vibrant tapestry of communities, ranging from bustling urban centers to tranquil rural landscapes. This diversity extends to its real estate, encompassing a wide spectrum of properties, each holding unique characteristics and values. To navigate this complex landscape, a comprehensive understanding of the Rankin County Tax Map becomes essential. This document serves as a vital tool for property owners, investors, developers, and government agencies alike, providing a structured framework for identifying, evaluating, and managing real estate within the county.

The Foundation of Property Management: Understanding the Tax Map

The Rankin County Tax Map is a meticulously compiled, digitized database that visually represents every parcel of land within the county’s boundaries. It functions as a visual index, assigning a unique identification number to each property, facilitating efficient tracking and management. This map is not merely a static visual representation; it integrates crucial data points for each property, including:

- Parcel Identification Number (PIN): This unique alphanumeric code acts as the primary identifier for each property, linking it to its corresponding information in the tax records.

- Legal Description: This detailed description outlines the property’s boundaries using specific legal terminology, ensuring clarity and accuracy in its definition.

- Ownership Information: The map records the names of the current property owners, allowing for easy identification and contact.

- Property Type: The map classifies properties based on their intended use, such as residential, commercial, industrial, or agricultural, providing insights into their potential and limitations.

- Assessed Value: This figure represents the estimated market value of the property, forming the basis for calculating property taxes.

- Tax History: The map tracks historical tax payments, providing a comprehensive overview of the property’s financial record.

- Zoning Information: This data highlights the specific zoning regulations applicable to each property, guiding development plans and ensuring compliance.

- Public Access: The map often incorporates information about access roads, utilities, and other public infrastructure, facilitating informed decision-making.

Benefits of the Rankin County Tax Map: A Gateway to Informed Decisions

The Rankin County Tax Map transcends its role as a simple visual representation, serving as a powerful tool for various stakeholders:

For Property Owners:

- Accurate Property Identification: The map provides a clear and concise identification of property boundaries, ensuring accurate ownership and avoiding potential disputes.

- Understanding Property Value: The assessed value information on the map provides a starting point for estimating market value and negotiating property transactions.

- Tracking Tax Payments: The map’s historical tax records facilitate efficient management of property tax obligations, preventing late payments and penalties.

- Planning for Development: The map’s zoning information guides property owners in planning for future development, ensuring compliance with local regulations.

For Investors:

- Market Research: The map offers valuable insights into property values, land availability, and zoning regulations, supporting informed investment decisions.

- Identifying Opportunities: By analyzing the map, investors can pinpoint potential development opportunities based on property type, location, and market demand.

- Assessing Risk: The map provides data on property taxes, historical ownership, and zoning, helping investors evaluate potential risks associated with specific properties.

For Developers:

- Site Selection: The map facilitates efficient site selection by providing comprehensive information on property boundaries, zoning, and access to utilities.

- Planning and Design: The map’s zoning information guides development plans, ensuring compliance with local regulations and minimizing potential delays.

- Project Feasibility: The map helps developers assess the feasibility of projects by providing data on property values, land availability, and potential development costs.

For Government Agencies:

- Tax Administration: The map streamlines tax administration by providing accurate property information, facilitating efficient assessment and collection of property taxes.

- Land Use Planning: The map serves as a vital resource for planning and zoning decisions, ensuring sustainable and responsible land development.

- Public Safety and Emergency Response: The map provides crucial information on property locations and access routes, aiding in emergency response and ensuring public safety.

Navigating the Rankin County Tax Map: A Practical Guide

Accessing and interpreting the Rankin County Tax Map is a straightforward process:

- Online Access: The Rankin County Tax Assessor’s website provides online access to the tax map, allowing users to search for specific properties by PIN, address, or owner name.

- Interactive Features: The online map often features interactive tools, allowing users to zoom in on specific areas, view property details, and access additional information.

- Contacting the Assessor’s Office: For assistance with accessing or interpreting the map, users can contact the Rankin County Tax Assessor’s office via phone or email.

Frequently Asked Questions (FAQs): Demystifying the Tax Map

Q1: What is the purpose of the Rankin County Tax Map?

A: The Rankin County Tax Map serves as a comprehensive database and visual representation of all properties within the county, facilitating property identification, management, and tax administration.

Q2: How can I access the Rankin County Tax Map?

A: The map is available online through the Rankin County Tax Assessor’s website.

Q3: What information is included on the Tax Map?

A: The map includes crucial information such as parcel identification numbers, legal descriptions, ownership information, property types, assessed values, tax history, zoning regulations, and public access details.

Q4: How can I use the Tax Map to find a specific property?

A: You can search for properties by PIN, address, or owner name using the online map’s search function.

Q5: Can I use the Tax Map to estimate the market value of a property?

A: The map provides the assessed value, which can serve as a starting point for estimating market value, but it is not a definitive measure.

Q6: What are the benefits of using the Tax Map?

A: The map provides accurate property information, facilitates informed decision-making, and supports efficient management of property assets.

Q7: Who can benefit from using the Tax Map?

A: The map is a valuable resource for property owners, investors, developers, government agencies, and anyone with an interest in real estate within Rankin County.

Tips for Utilizing the Rankin County Tax Map:

- Familiarize yourself with the map’s features: Explore the online map’s functionalities, including search options, zoom levels, and additional information resources.

- Use multiple search methods: Utilize different search criteria, such as PIN, address, or owner name, to ensure comprehensive results.

- Verify property information: Always verify information obtained from the map with official records or by contacting the Tax Assessor’s office.

- Consider professional assistance: For complex transactions or development projects, consult with a qualified real estate professional or surveyor.

- Stay updated on map changes: The Tax Map is regularly updated, so ensure you are accessing the most current version.

Conclusion: A Powerful Tool for Understanding Rankin County’s Real Estate Landscape

The Rankin County Tax Map serves as a vital resource for navigating the complexities of real estate within the county. By providing comprehensive and accurate information, it empowers property owners, investors, developers, and government agencies to make informed decisions, manage property assets effectively, and contribute to the sustainable growth of the county.

![Rankin County Map Book - [PDF Document]](https://static.fdocuments.in/doc/1200x630/619f3943241b1a63930f9080/rankin-county-map-book.jpg?t=1682481737)

Closure

Thus, we hope this article has provided valuable insights into Unlocking the Secrets of Rankin County: A Comprehensive Guide to the Tax Map. We thank you for taking the time to read this article. See you in our next article!