Navigating The Landscape: A Comprehensive Guide To Greenville County’s Tax Map

Navigating the Landscape: A Comprehensive Guide to Greenville County’s Tax Map

Related Articles: Navigating the Landscape: A Comprehensive Guide to Greenville County’s Tax Map

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Landscape: A Comprehensive Guide to Greenville County’s Tax Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape: A Comprehensive Guide to Greenville County’s Tax Map

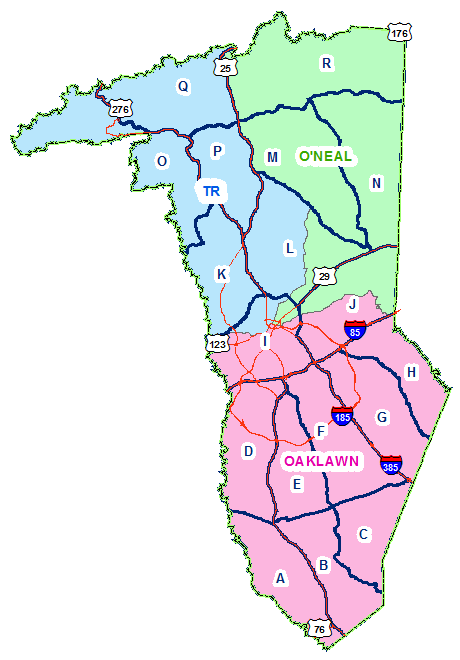

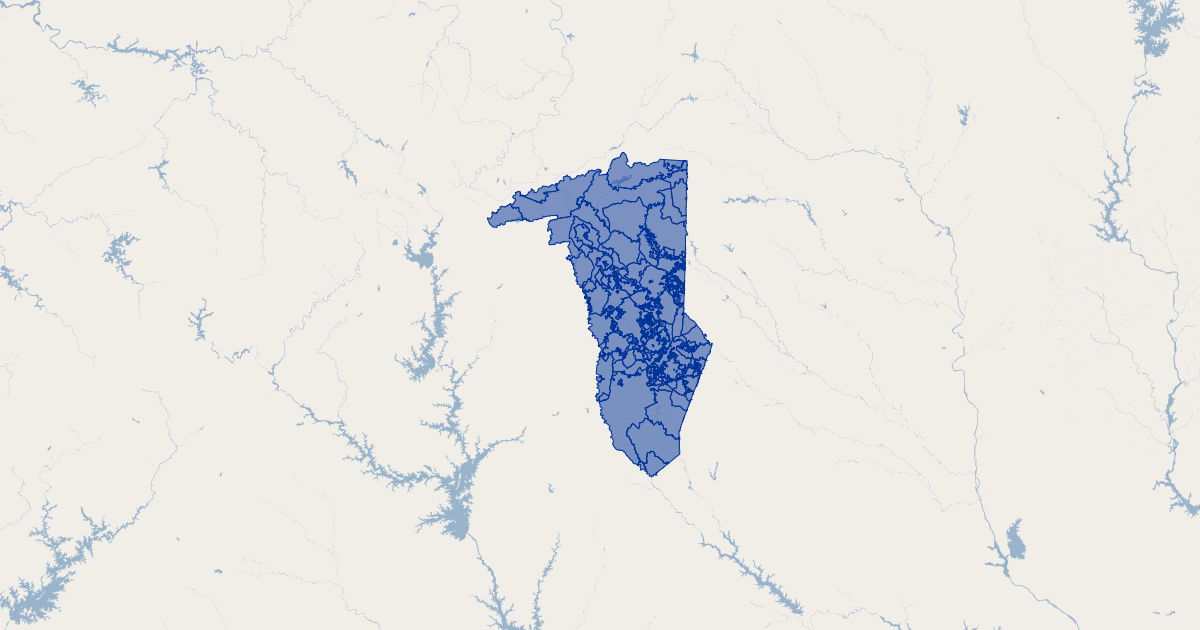

Greenville County, South Carolina, is a vibrant hub of economic activity and residential growth. To facilitate efficient administration and transparent governance, the county maintains a detailed and comprehensive tax map, a critical tool for understanding property ownership, taxation, and land use. This document, readily available online and through county offices, serves as a vital resource for various stakeholders, including property owners, investors, developers, and government agencies.

Unveiling the Layers of Information:

The Greenville County tax map is more than just a visual representation of property boundaries. It is a meticulously curated database, encompassing a wealth of information about every parcel of land within the county. Key elements of the map include:

- Parcel Identification Numbers (PINs): Each property is assigned a unique PIN, serving as its primary identifier across all county records. This number acts as a key to access comprehensive details about the property.

- Property Boundaries: The map precisely delineates the boundaries of each parcel, ensuring clarity and avoiding disputes over ownership.

- Land Use Categories: The map categorizes each property based on its current use, whether residential, commercial, industrial, agricultural, or other designated classifications.

- Tax Assessment Information: The map displays the assessed value of each property, a critical factor in calculating property taxes. This information is crucial for property owners to understand their tax obligations and for potential buyers to assess property value.

- Ownership Details: The map identifies the legal owner(s) of each property, providing a clear record of ownership. This information is essential for real estate transactions, legal proceedings, and property management.

- Historical Records: The map often includes historical data, such as past ownership, land use changes, and property renovations. This historical context provides valuable insights for understanding the evolution of a property and its surrounding area.

Beyond the Map: The Power of Geographic Information Systems (GIS):

The Greenville County tax map is not merely a static document. It is a dynamic database integrated with a powerful Geographic Information System (GIS). This technology enhances the map’s functionality, enabling users to:

- Interactive Exploration: GIS allows users to zoom in and out of the map, explore specific areas, and access detailed information about individual properties.

- Spatial Analysis: GIS tools facilitate analysis of spatial relationships between properties, land use patterns, and other geographic factors. This capability is invaluable for planning and development projects, environmental studies, and infrastructure management.

- Data Visualization: GIS enables the creation of thematic maps, visualizing data related to property values, land use changes, population density, and other relevant variables. These visualizations provide a clear and intuitive understanding of spatial patterns and trends.

- Data Integration: GIS facilitates the integration of data from various sources, such as property records, zoning regulations, utility maps, and environmental databases. This integration allows for comprehensive analysis and informed decision-making.

The Benefits of a Comprehensive Tax Map:

The Greenville County tax map, coupled with GIS technology, offers a multitude of benefits to the community:

- Transparency and Accountability: The map provides a transparent and accessible record of property ownership and taxation, fostering trust and accountability in government operations.

- Efficient Property Management: The map streamlines property management processes, allowing for accurate record-keeping, efficient tax collection, and effective land use planning.

- Informed Decision-Making: The map empowers investors, developers, and community stakeholders with crucial information for making informed decisions about real estate transactions, property development, and infrastructure projects.

- Economic Development: The map facilitates economic development by providing valuable insights into land availability, property values, and potential development opportunities.

- Environmental Stewardship: The map aids in environmental planning and management by providing information on land use patterns, potential environmental hazards, and areas requiring protection.

- Public Safety: The map assists in emergency response planning, crime prevention, and disaster relief efforts by providing detailed information about property locations and infrastructure.

FAQs about the Greenville County Tax Map:

1. How can I access the Greenville County tax map?

The map is readily accessible online through the Greenville County website, where users can search for specific properties, explore the map interactively, and download data. It is also available for review at the Greenville County Assessor’s Office.

2. What information can I find on the tax map?

The map provides detailed information about each property, including its PIN, boundaries, land use, assessed value, ownership details, and historical records.

3. How do I use the GIS features of the tax map?

The online version of the map offers interactive tools for zooming, panning, searching, and accessing detailed property information. Users can also utilize GIS tools for spatial analysis and data visualization.

4. How is the tax map updated?

The tax map is continuously updated to reflect changes in property ownership, land use, and other relevant data. Updates are typically made on a quarterly or annual basis.

5. How can I contact the Greenville County Assessor’s Office for assistance?

The Assessor’s Office can be contacted by phone, email, or in person at their office located at [Insert Address].

Tips for Using the Greenville County Tax Map:

- Familiarize yourself with the map’s features: Spend time exploring the online interface to understand its functionality and how to access specific information.

- Utilize the search function: The map’s search function allows you to quickly locate properties by PIN, address, or owner name.

- Explore the GIS tools: Utilize the map’s GIS features for spatial analysis, data visualization, and creating custom maps.

- Contact the Assessor’s Office for assistance: If you have any questions or need help navigating the map, reach out to the Assessor’s Office for support.

- Stay updated on map changes: The map is constantly updated, so it is essential to check for the latest information before making important decisions.

Conclusion:

The Greenville County tax map, powered by GIS technology, is a valuable tool for understanding property ownership, taxation, and land use in the county. Its comprehensiveness, accessibility, and dynamic nature empower residents, businesses, and government agencies to make informed decisions, promote transparency, and foster responsible development. As Greenville County continues to grow and evolve, the tax map will remain an indispensable resource for navigating the changing landscape and shaping the future of the community.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape: A Comprehensive Guide to Greenville County’s Tax Map. We thank you for taking the time to read this article. See you in our next article!