Navigating Property Ownership: A Comprehensive Guide To The York County Tax Map

Navigating Property Ownership: A Comprehensive Guide to the York County Tax Map

Related Articles: Navigating Property Ownership: A Comprehensive Guide to the York County Tax Map

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating Property Ownership: A Comprehensive Guide to the York County Tax Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Property Ownership: A Comprehensive Guide to the York County Tax Map

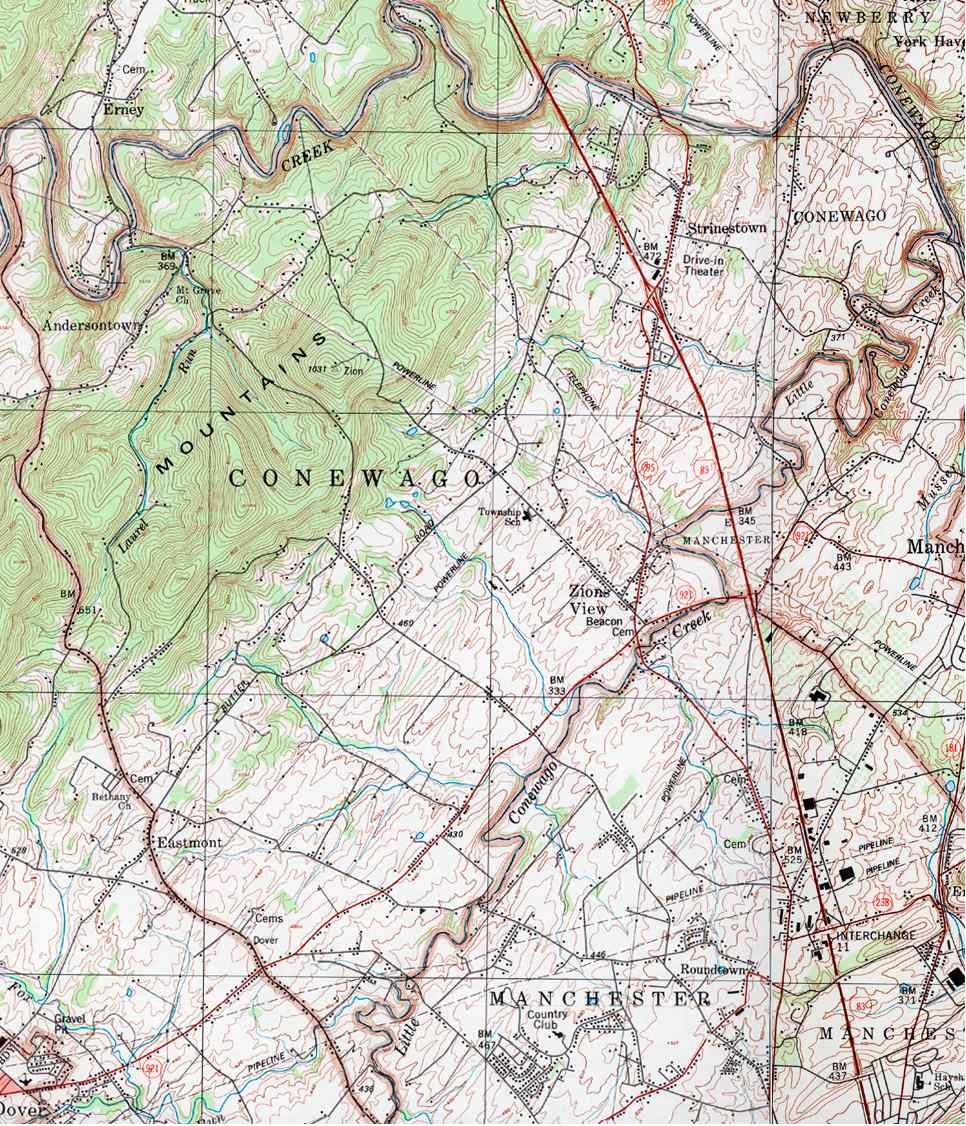

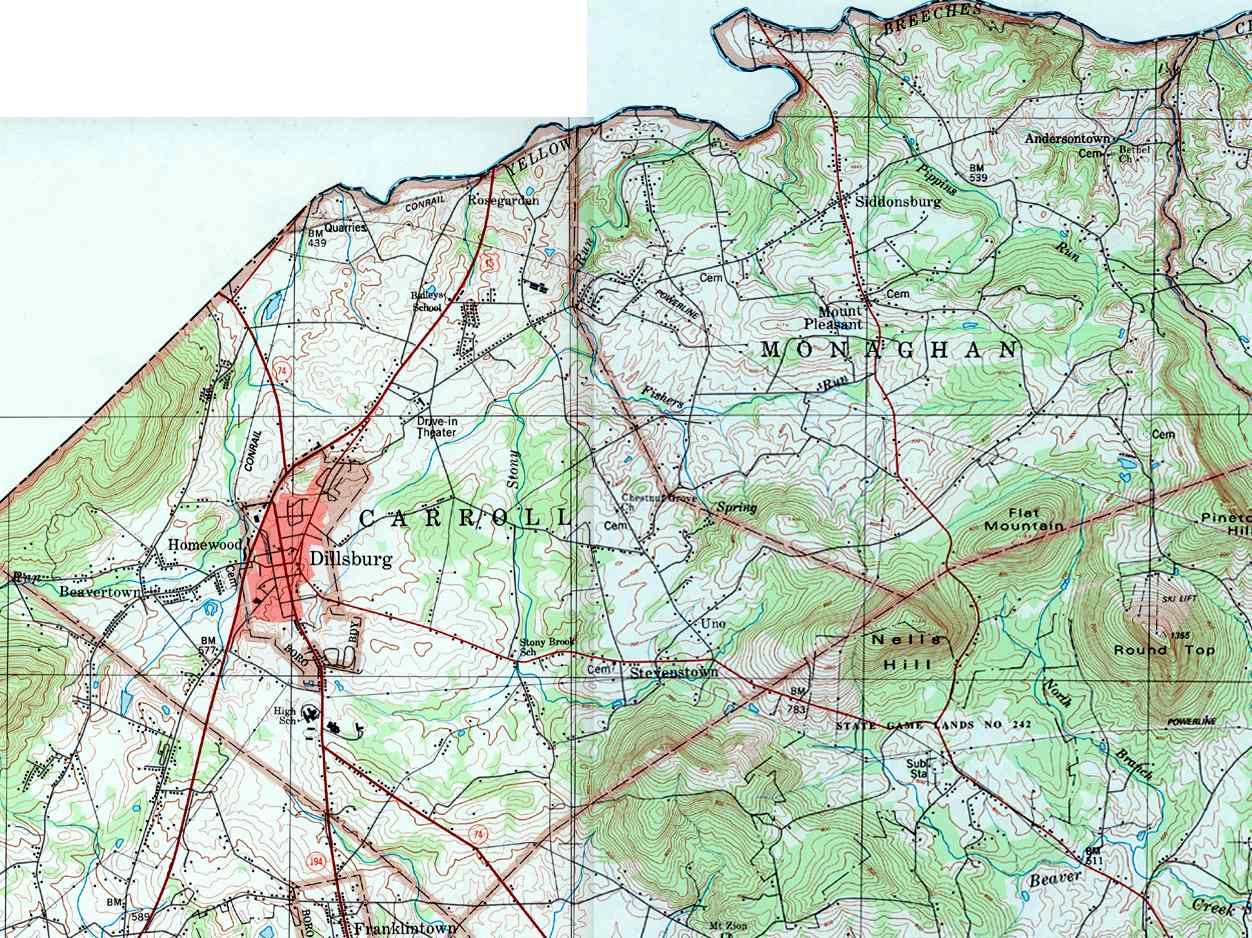

The York County Tax Map, a meticulously crafted spatial database, serves as a fundamental tool for understanding and managing property within the county. It provides a comprehensive visual representation of land parcels, their boundaries, ownership details, and associated tax information. This detailed and interactive resource is invaluable for a wide range of stakeholders, including property owners, real estate professionals, government agencies, and developers.

Understanding the Structure of the York County Tax Map

The York County Tax Map is organized using a hierarchical system that allows for efficient navigation and data retrieval. The core elements of the map include:

- Parcels: Each individual piece of land within the county is designated as a separate parcel, identified by a unique parcel number. This number serves as a primary key for accessing all associated information.

- Boundaries: Each parcel is defined by its precise boundaries, which are established through surveys and legal descriptions. These boundaries are visually represented on the map, allowing for clear identification of property lines.

- Ownership Information: The map contains detailed ownership records for each parcel, including the names and contact information of the current owner, as well as any historical ownership data.

- Tax Information: The map displays the assessed value of each parcel, along with relevant tax rates and any outstanding tax liabilities. This information is essential for property owners to understand their tax obligations and for government agencies to manage tax collection.

Accessing the York County Tax Map

The York County Tax Map is typically accessible through an online portal maintained by the county assessor’s office. This portal offers user-friendly interfaces that allow for various search options, including:

- Parcel Number Search: Entering the unique parcel number provides instant access to all associated data, including ownership information, tax details, and property boundaries.

- Address Search: Searching by street address allows users to locate specific properties and access their corresponding data.

- Map Navigation: The online map provides interactive tools for zooming, panning, and measuring distances. This allows users to visually explore the county and identify specific properties of interest.

Benefits of Utilizing the York County Tax Map

The York County Tax Map offers numerous benefits to a diverse group of users:

- Property Owners: Provides an accurate and up-to-date representation of their property, including boundaries, assessed value, and tax information. This allows for informed decision-making regarding property management, financing, and potential sales.

- Real Estate Professionals: Facilitates efficient property searches, allowing for quick identification of properties that meet specific criteria. The map also provides valuable insights into property values, market trends, and ownership history.

- Government Agencies: Enables streamlined tax collection, property assessment, and land management processes. The map serves as a central repository for accurate and comprehensive property data, supporting efficient administration and planning.

- Developers: Provides a clear understanding of available land parcels, zoning regulations, and potential development constraints. This information is crucial for planning and executing successful development projects.

FAQs Regarding the York County Tax Map

1. How do I find my property on the map?

You can search for your property by parcel number, address, or by navigating the interactive map.

2. What information is available on the map?

The map provides parcel boundaries, ownership details, assessed value, tax information, and potentially other relevant data, such as zoning regulations and property history.

3. How often is the map updated?

The map is typically updated periodically, often on an annual basis, to reflect changes in property ownership, assessments, and other relevant data.

4. What if I find an error on the map?

If you identify an error on the map, it is important to contact the county assessor’s office immediately. They will investigate the discrepancy and take steps to correct any inaccuracies.

5. Is the map available in different formats?

The map may be available in various formats, including online portals, downloadable PDF files, and potentially GIS data formats. Contact the county assessor’s office for specific format options.

Tips for Effective Use of the York County Tax Map

- Familiarize yourself with the map interface: Spend time navigating the map and exploring its features to ensure you understand how to effectively search for information.

- Utilize available search options: Utilize all available search options, including parcel number, address, and map navigation tools, to efficiently locate the property of interest.

- Verify information: Always verify the accuracy of information obtained from the map by cross-referencing with other sources, such as property deeds or tax bills.

- Contact the county assessor’s office: If you have any questions or require assistance, contact the county assessor’s office for guidance and support.

Conclusion

The York County Tax Map serves as a vital resource for understanding and managing property within the county. Its comprehensive and interactive nature allows for efficient data retrieval, informed decision-making, and streamlined administrative processes. By leveraging the benefits of this valuable tool, stakeholders can gain a clear and accurate understanding of property ownership, tax obligations, and related information, fostering transparency and facilitating responsible land management practices within York County.

Closure

Thus, we hope this article has provided valuable insights into Navigating Property Ownership: A Comprehensive Guide to the York County Tax Map. We hope you find this article informative and beneficial. See you in our next article!