Delving Into The Sussex County Tax Map: A Comprehensive Guide

Delving into the Sussex County Tax Map: A Comprehensive Guide

Related Articles: Delving into the Sussex County Tax Map: A Comprehensive Guide

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Delving into the Sussex County Tax Map: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Delving into the Sussex County Tax Map: A Comprehensive Guide

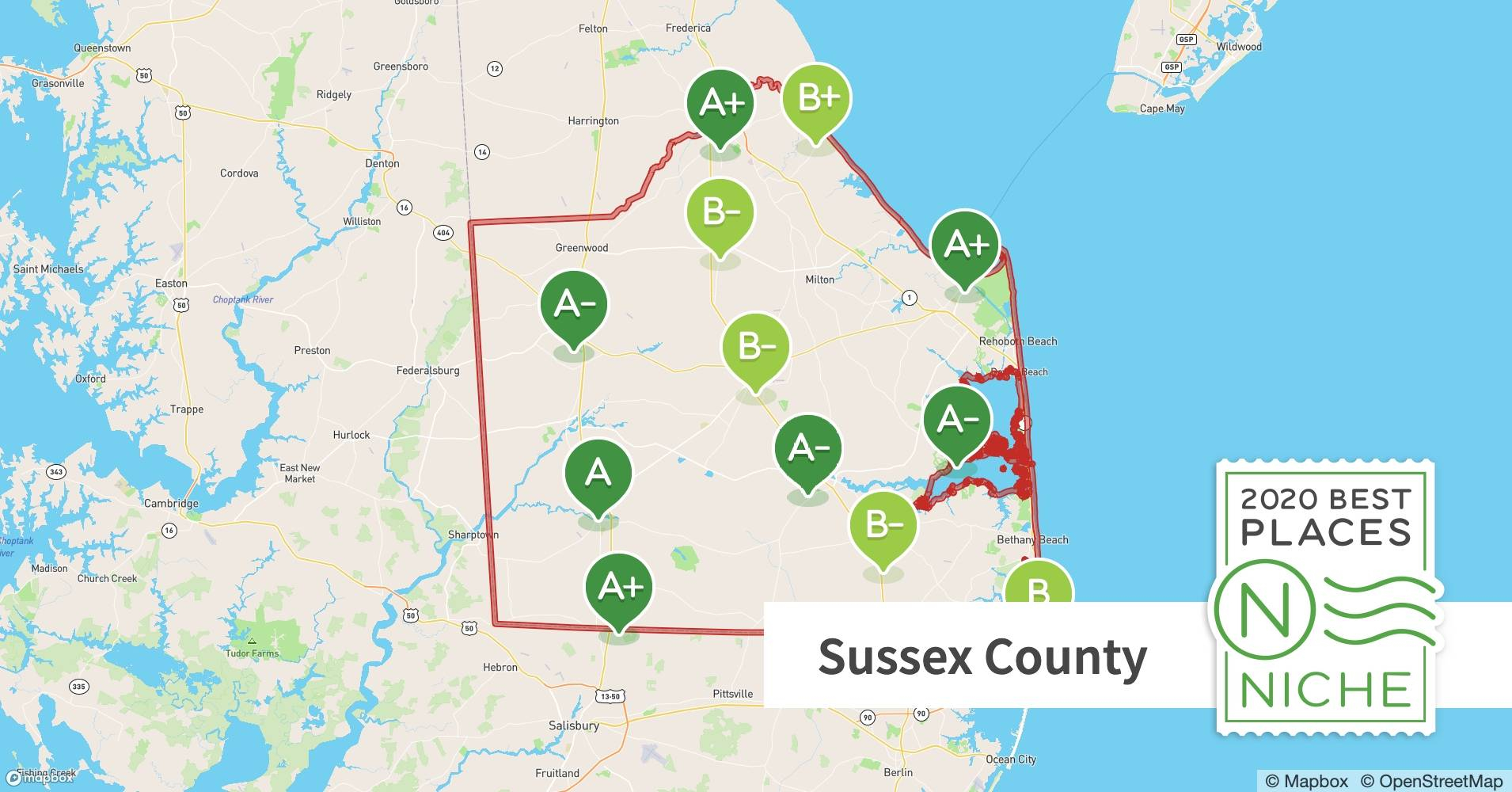

The Sussex County Tax Map, a vital resource for navigating property information within the county, provides a detailed and comprehensive overview of land ownership, property boundaries, and tax assessments. This map is not merely a static representation of physical land; it serves as a foundation for various crucial functions, including:

- Property Assessment and Taxation: The map forms the basis for assessing property values and determining the corresponding tax obligations. This ensures equitable distribution of tax burdens across the county.

- Land Use Planning and Development: The map provides valuable insights into land ownership, zoning regulations, and existing infrastructure, enabling informed decisions regarding development projects and land use policies.

- Emergency Response and Disaster Management: During emergencies, the tax map assists first responders in identifying property boundaries, accessing critical infrastructure, and coordinating rescue efforts effectively.

- Legal and Regulatory Compliance: The map plays a crucial role in resolving land disputes, facilitating property transactions, and ensuring adherence to legal requirements related to land ownership and development.

- Historical and Archival Research: The tax map provides a historical record of land ownership and development patterns, offering valuable insights for researchers studying the county’s evolution over time.

Understanding the Structure of the Sussex County Tax Map

The Sussex County Tax Map is typically organized in a hierarchical structure, combining various layers of information to create a comprehensive picture. These layers can include:

- Base Map: This forms the foundation of the map and usually includes geographical features like roads, rivers, and boundaries.

- Parcel Boundaries: These define individual property lines and are often represented by distinct colors or lines on the map.

- Property Identification Numbers: Each parcel is assigned a unique identification number, linking it to associated records and information.

- Tax Assessment Information: The map may display information regarding assessed values, property classifications, and tax rates.

- Zoning and Land Use Regulations: This layer indicates permissible land uses and development restrictions based on zoning regulations.

- Infrastructure Data: Information regarding utilities, roads, and other infrastructure can be incorporated into the map.

Accessing and Utilizing the Sussex County Tax Map

The Sussex County Tax Map is typically available through multiple channels:

- County Website: Most counties maintain online versions of their tax maps, often accessible through a dedicated web portal or GIS viewer.

- County Tax Assessor’s Office: This office serves as a primary resource for accessing the map, providing both digital and physical copies.

- Private Mapping Services: Commercial mapping companies often offer access to county tax maps, sometimes integrated with additional data and analytical tools.

Utilizing the tax map requires understanding its key elements and navigation features. Users can typically search for properties by address, parcel number, or other relevant criteria. The map may also offer interactive features, allowing users to zoom, pan, and layer different information for detailed analysis.

FAQs Regarding the Sussex County Tax Map

1. How can I find my property on the Sussex County Tax Map?

To find your property, you can search by address, parcel number, or owner’s name. The map’s search function will guide you to the corresponding location.

2. What information can I find on the Sussex County Tax Map?

The map provides information on property boundaries, ownership details, tax assessment values, zoning regulations, and infrastructure.

3. How do I update my property information on the Sussex County Tax Map?

Any changes to your property, such as address updates or ownership transfers, should be reported to the County Tax Assessor’s Office. They will update the official records accordingly.

4. What is the purpose of the tax map’s zoning layer?

The zoning layer indicates permissible land uses and development restrictions for each property, ensuring compliance with local regulations.

5. How can I use the Sussex County Tax Map for land development purposes?

The map provides valuable insights into property boundaries, zoning regulations, and existing infrastructure, aiding in planning and feasibility assessments for development projects.

Tips for Effective Use of the Sussex County Tax Map

- Familiarize yourself with the map’s navigation features: Understand how to zoom, pan, and layer different information for optimal analysis.

- Utilize the map’s search functions: Search by address, parcel number, or other criteria to quickly locate specific properties.

- Consult the legend and key: Understand the symbols and colors used on the map to represent different features and information.

- Cross-reference with other resources: Combine the tax map with other data sources, such as zoning ordinances or property records, for a more comprehensive understanding.

- Contact the County Tax Assessor’s Office for assistance: If you encounter difficulties or have specific questions, seek guidance from the experts.

Conclusion

The Sussex County Tax Map is an indispensable tool for navigating property information and understanding the intricate web of land ownership, development, and taxation within the county. By providing a comprehensive and accessible platform for accessing crucial data, the map empowers individuals, businesses, and government agencies to make informed decisions, ensure legal compliance, and contribute to the sustainable development of the county. As technology continues to evolve, we can expect the Sussex County Tax Map to become even more sophisticated and integrated, further enhancing its value and relevance for years to come.

Closure

Thus, we hope this article has provided valuable insights into Delving into the Sussex County Tax Map: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!