Delving Into The Rankin County Tax Map: A Comprehensive Guide

Delving into the Rankin County Tax Map: A Comprehensive Guide

Related Articles: Delving into the Rankin County Tax Map: A Comprehensive Guide

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Delving into the Rankin County Tax Map: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Delving into the Rankin County Tax Map: A Comprehensive Guide

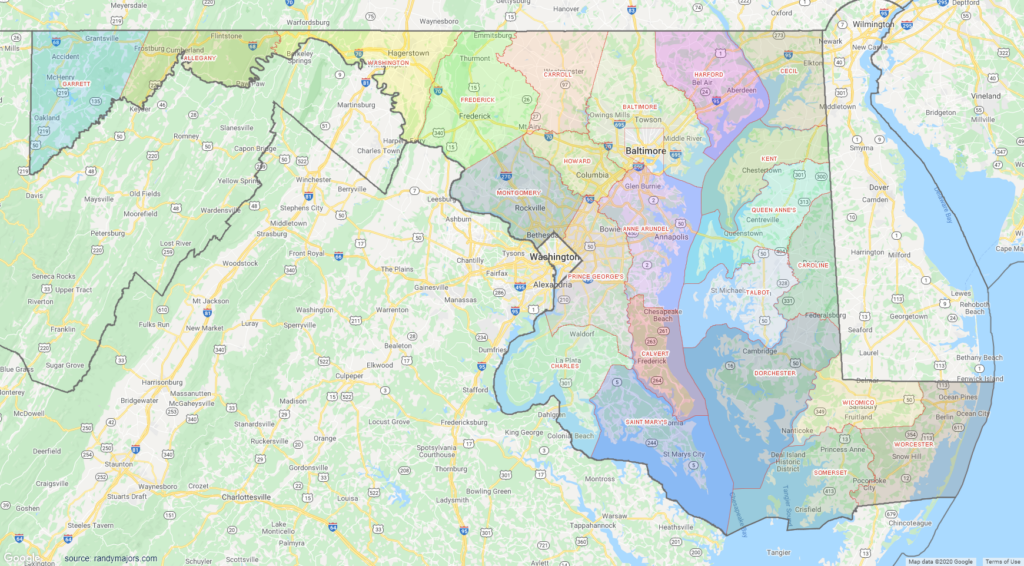

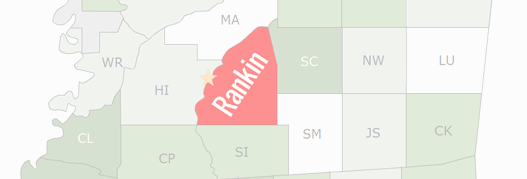

The Rankin County Tax Map is a vital tool for understanding the county’s real estate landscape. It serves as a comprehensive database, providing detailed information about property ownership, boundaries, values, and tax assessments. This intricate map is a cornerstone for various stakeholders, including property owners, investors, government officials, and developers.

Understanding the Structure and Content

The Rankin County Tax Map is a digital representation of the county’s geographical area, divided into parcels. Each parcel represents a unique piece of land, and the map contains a wealth of information associated with each one:

- Parcel Identification Number (PIN): This unique identifier acts as the primary key for each parcel, linking it to all relevant data.

- Property Address: This provides a clear location reference for each parcel.

- Legal Description: A detailed legal description of the property boundaries, ensuring accuracy and legal clarity.

- Ownership Information: The names and contact details of the current property owners are crucial for communication and tax administration.

- Land Use: The map indicates the current use of the property, such as residential, commercial, agricultural, or industrial.

- Tax Assessment: This reflects the estimated market value of the property, which forms the basis for calculating property taxes.

- Tax History: The map records past tax payments and any outstanding balances, allowing for transparent financial tracking.

- Zoning Information: This outlines the permitted land uses and development regulations within the area.

Benefits and Applications

The Rankin County Tax Map serves as a valuable resource for a wide range of purposes:

- Property Owners: Owners can access information about their property, including its legal description, assessed value, and tax status. This allows them to manage their properties effectively, track tax payments, and resolve any discrepancies.

- Real Estate Professionals: Realtors, appraisers, and investors rely on the map to conduct market research, analyze property values, and identify potential investment opportunities. It provides a comprehensive overview of the real estate market within the county.

- Government Officials: The map is crucial for tax assessment and collection, land use planning, and property development regulation. It enables efficient administration and helps ensure equitable tax burden distribution.

- Developers: Developers use the map to identify suitable land for new projects, assess zoning regulations, and understand existing infrastructure, aiding in the planning and execution of development initiatives.

- Public Access: The map is often accessible to the general public, providing transparency and empowering citizens to make informed decisions related to property and development.

Navigating the Rankin County Tax Map

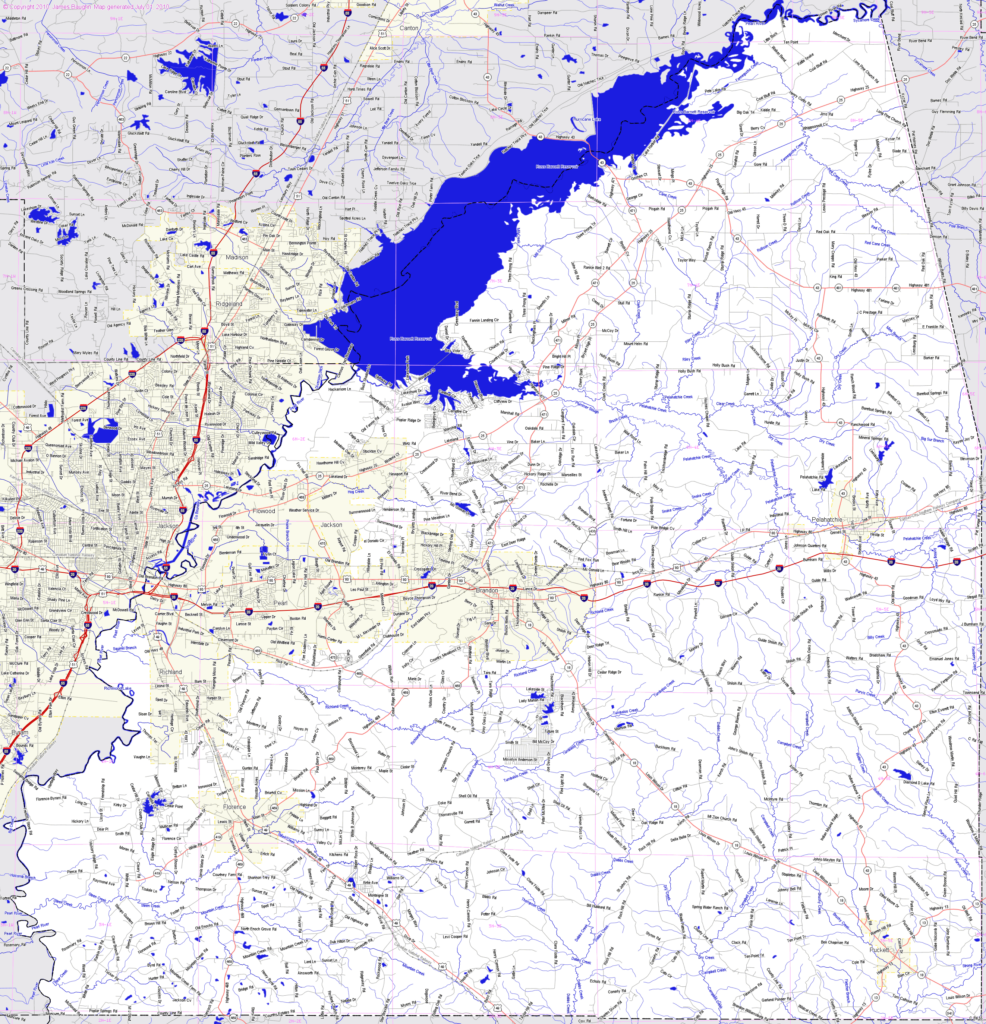

The Rankin County Tax Map is typically accessible online through the county’s official website. Users can search for specific properties by entering the PIN, address, or owner’s name. The map offers various functionalities, including:

- Zoom and Pan: Allowing users to explore specific areas of interest in detail.

- Layer Control: Enabling users to toggle different layers of information, such as property boundaries, tax assessments, or zoning regulations, to focus on specific data sets.

- Property Detail Pages: Clicking on a specific parcel opens a detailed page with all relevant information, including ownership details, tax history, and assessments.

- Download Options: Users may be able to download map data in various formats, such as PDF or shapefiles, for further analysis or integration into other systems.

FAQs about the Rankin County Tax Map

1. How do I find my property on the map?

You can search for your property by entering the PIN, address, or owner’s name into the search bar provided on the county’s website.

2. What if my property information is incorrect?

Contact the Rankin County Tax Assessor’s office to report any discrepancies and initiate the necessary correction process.

3. How can I appeal my property tax assessment?

The Rankin County Tax Assessor’s office provides information on the appeal process, outlining the steps and deadlines for filing an appeal.

4. Where can I access the map online?

The map is typically available on the Rankin County website or through a designated online mapping portal.

5. Is the map updated regularly?

The map is updated periodically to reflect changes in property ownership, boundaries, and assessments. It is important to refer to the most recent version for accurate information.

Tips for Using the Rankin County Tax Map

- Familiarize yourself with the map’s functionalities: Take time to explore the map’s features and understand how to navigate and search for specific information.

- Use the search options effectively: Utilize the available search functions to locate specific properties or areas of interest efficiently.

- Pay attention to the map’s legend: The legend provides a key to understanding the symbols and colors used on the map, ensuring proper interpretation of the data.

- Verify information with official sources: Always confirm information obtained from the map with official documents, such as property deeds or tax records.

- Contact the Tax Assessor’s office for assistance: If you encounter any difficulties using the map or have questions about property information, reach out to the Rankin County Tax Assessor’s office for guidance.

Conclusion

The Rankin County Tax Map is an invaluable tool for understanding and managing real estate within the county. It provides a comprehensive and transparent source of information, facilitating informed decision-making for property owners, investors, government officials, and developers. By utilizing the map’s functionalities and accessing the relevant information, users can gain valuable insights into the county’s real estate landscape, promoting efficient land management and development practices.

![Rankin County Map Book - [PDF Document]](https://static.fdocuments.in/doc/1200x630/619f3943241b1a63930f9080/rankin-county-map-book.jpg?t=1682481737)

Closure

Thus, we hope this article has provided valuable insights into Delving into the Rankin County Tax Map: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!