A Comprehensive Guide To Jefferson County Tax Maps: Understanding The Foundation Of Property Information

A Comprehensive Guide to Jefferson County Tax Maps: Understanding the Foundation of Property Information

Related Articles: A Comprehensive Guide to Jefferson County Tax Maps: Understanding the Foundation of Property Information

Introduction

With great pleasure, we will explore the intriguing topic related to A Comprehensive Guide to Jefferson County Tax Maps: Understanding the Foundation of Property Information. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

A Comprehensive Guide to Jefferson County Tax Maps: Understanding the Foundation of Property Information

.png)

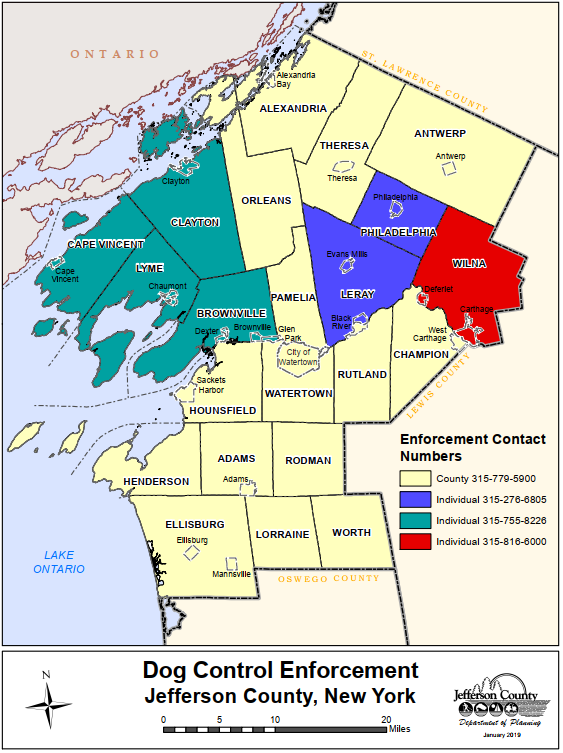

Jefferson County tax maps are a vital tool for understanding property ownership, boundaries, and values within the county. These maps, often digitized and accessible online, provide a visual representation of the intricate web of land parcels, offering a wealth of information for various stakeholders. This article delves into the intricacies of Jefferson County tax maps, exploring their structure, uses, and significance in the broader context of property management and development.

Understanding the Structure of a Jefferson County Tax Map

Jefferson County tax maps are essentially graphical representations of the county’s land, divided into individual parcels. Each parcel is assigned a unique identification number, the "parcel ID," which serves as a primary key for accessing detailed information about the property. The maps typically depict:

- Parcel Boundaries: Clearly defined lines outlining the physical extent of each individual property.

- Property Addresses: The official street address associated with the parcel, facilitating property identification.

- Land Use: A designation indicating the primary use of the land, such as residential, commercial, or agricultural.

- Zoning: The specific zoning regulations that apply to the property, outlining permitted land uses and development restrictions.

- Ownership Information: Details about the current owner, including their name and contact information.

- Assessment Information: The assessed value of the property for tax purposes, providing a basis for calculating property taxes.

The Importance of Jefferson County Tax Maps

The significance of Jefferson County tax maps extends far beyond their function as a simple visual representation of land ownership. They serve as a foundational resource for a wide range of individuals and organizations, including:

- Property Owners: Accessing their property information, including boundaries, assessed value, and zoning regulations.

- Real Estate Professionals: Identifying potential properties, researching market trends, and conducting due diligence on property transactions.

- Developers: Planning new construction projects, understanding zoning restrictions, and assessing the feasibility of development proposals.

- Government Agencies: Managing property taxes, implementing land use planning policies, and responding to public inquiries about property information.

- Financial Institutions: Assessing property values for loan applications, conducting risk assessments, and managing real estate investments.

- Legal Professionals: Resolving property disputes, conducting title searches, and establishing property ownership rights.

Utilizing Jefferson County Tax Maps: A Practical Guide

Accessing and interpreting Jefferson County tax maps is a straightforward process, typically involving the following steps:

- Identifying the Appropriate Online Platform: Many counties offer their tax maps through dedicated websites or portals.

- Navigating the Map Interface: Most platforms provide interactive tools for zooming, panning, and searching by address or parcel ID.

- Selecting a Specific Parcel: Clicking on a parcel will typically display a pop-up window containing detailed information about the property.

- Accessing Additional Information: The pop-up window may provide links to additional resources, such as property tax records, zoning regulations, and deed information.

Frequently Asked Questions (FAQs) about Jefferson County Tax Maps

1. How can I access Jefferson County tax maps online?

The availability and access methods for Jefferson County tax maps vary depending on the specific county. Typically, the county assessor’s website or a designated property information portal will provide access to online tax maps.

2. What information can I find on a Jefferson County tax map?

Jefferson County tax maps provide a wealth of information about individual parcels, including boundaries, addresses, land use, zoning, ownership details, and assessed value.

3. Can I use Jefferson County tax maps for real estate transactions?

While tax maps offer valuable information, they should not be considered a substitute for a comprehensive property inspection and title search. Real estate transactions require professional guidance and due diligence.

4. Are Jefferson County tax maps updated regularly?

Tax maps are generally updated periodically, reflecting changes in property ownership, boundaries, and assessments. However, it’s essential to verify the map’s last update date to ensure accuracy.

5. How can I report inaccuracies on a Jefferson County tax map?

Most county assessor offices provide contact information and procedures for reporting inaccuracies or discrepancies on their tax maps.

Tips for Using Jefferson County Tax Maps Effectively

- Familiarize Yourself with the Map Interface: Spend time exploring the online platform’s functionalities to optimize your search experience.

- Verify the Map’s Update Date: Ensure that the map you are using is current and reflects the most recent changes.

- Consult Additional Resources: Utilize links to property tax records, zoning regulations, and deed information provided on the map platform.

- Seek Professional Guidance: For complex property transactions or legal matters, consult with a qualified real estate professional or attorney.

Conclusion

Jefferson County tax maps are a vital resource for understanding property information and facilitating various real estate-related activities. By providing a visual representation of land ownership, boundaries, and values, these maps empower individuals, businesses, and government agencies to make informed decisions related to property management, development, and investment. Utilizing tax maps effectively requires understanding their structure, accessing relevant information, and navigating the online platforms that host them. By leveraging this valuable tool, stakeholders can navigate the complex world of property ownership and make informed decisions regarding their real estate interests.

Closure

Thus, we hope this article has provided valuable insights into A Comprehensive Guide to Jefferson County Tax Maps: Understanding the Foundation of Property Information. We thank you for taking the time to read this article. See you in our next article!